About Us

SecureNow TechServices is an insurance-focused technology solution firm. We help our clients fully digitize their customer buying journey, customer service and operations. Our solutions help clients leverage proprietary data to extract relevant business intelligence and augment growth and profitability.

Deep Domain Knowledge

The management team collectively has 100+ years of experience in insurance. Experience includes building systems for insurers, intermediaries, and shared services organizations. A strong understanding of regulation and varied products - property & casualty, health and life insurances - helps deliver compliant solutions.

Technology Expertise

We have specialized teams focused on product development, user experience optimization, engineering & architecture, and ecosystem development. Cross-functional knowledge helps develop and deliver a holistic solution for the client

Off-the-shelf platforms

Due to the sharp domain focus, we have developed a library of codes and framework relevant for insurance. This helps us deliver a faster, better and cheaper turnkey solution to our clients.

Solid UX know-how

Through continuous research in user experience via interview and focus group discussions, we have developed a deep understanding of expectations of various stakeholders in the insurance value chain. This helps us design user-friendly applications that are easy to use.

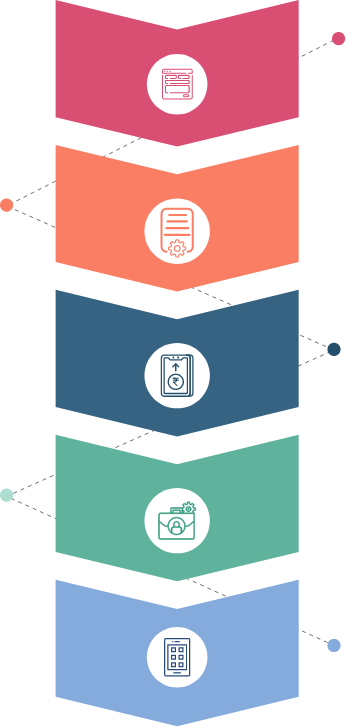

1. User Buying Journey

Lead Generation

Launch customer-friendly sites to share information with strong call to action. Generate organic and inorganic leads for a range of products across varied geographies.

Automated quotations

Enable instant quotation for prospective clients. Develop proprietary pricing algorithms. Activate repository to enable continuous refinement and micro-targeting

Digitize Payments

Integrate digital payment solutions to offer instant fulfilment solutions. Offer both assisted and unassisted customer journeys to users.

Client portfolio tool

Offer one-stop portfolio access to users to view and manage multiple insurances over time. Enable easy access to policy, and claim information.

Mobile application

Convert the digital platform to an omni-device solution. Offer access on native mobile apps on Android and iOS.

2. Customer Service

eClaims

Digitize the claim filing process. Reduce paperwork, and enable auto-fill claim for users. Leverage artificial intelligence to auto-adjudicate claims.

Customer response system

Transition to one-email across the firm. Implement centralized ticketing solution to assign emails to respective departments.

Centralized number

Move to one phone number across the firm. Leverage a centralized call routing solution to skip IVR and automatically identify relevant person for a client query.

3. Operations

Underwriting module

Map underwriting variables to pricing algorithms. Enable quick analysis of proposals, easy bench-marking, and loss-ratio predictions.

Renewal module

Manage all renewal intimations centrally. Auto-generate renewal payment links to implement unassisted customer payments.

Policy Administration System

Manage all policy information centrally across all branches and regions. Have a central repository to store premium register, endorsements, claims, service requests, sales-team productivity, and inter-function coordination.